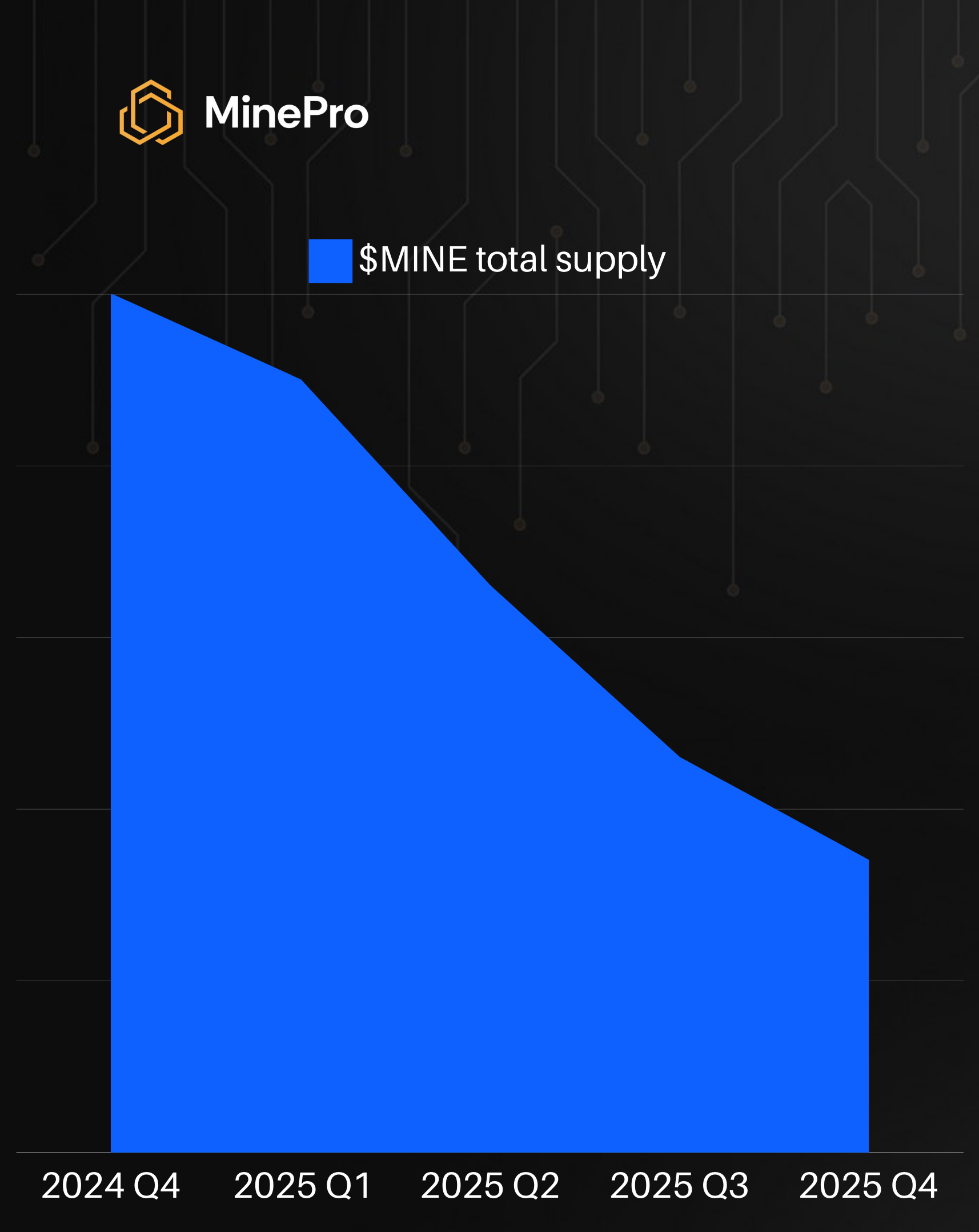

$MINE as an economic enigma

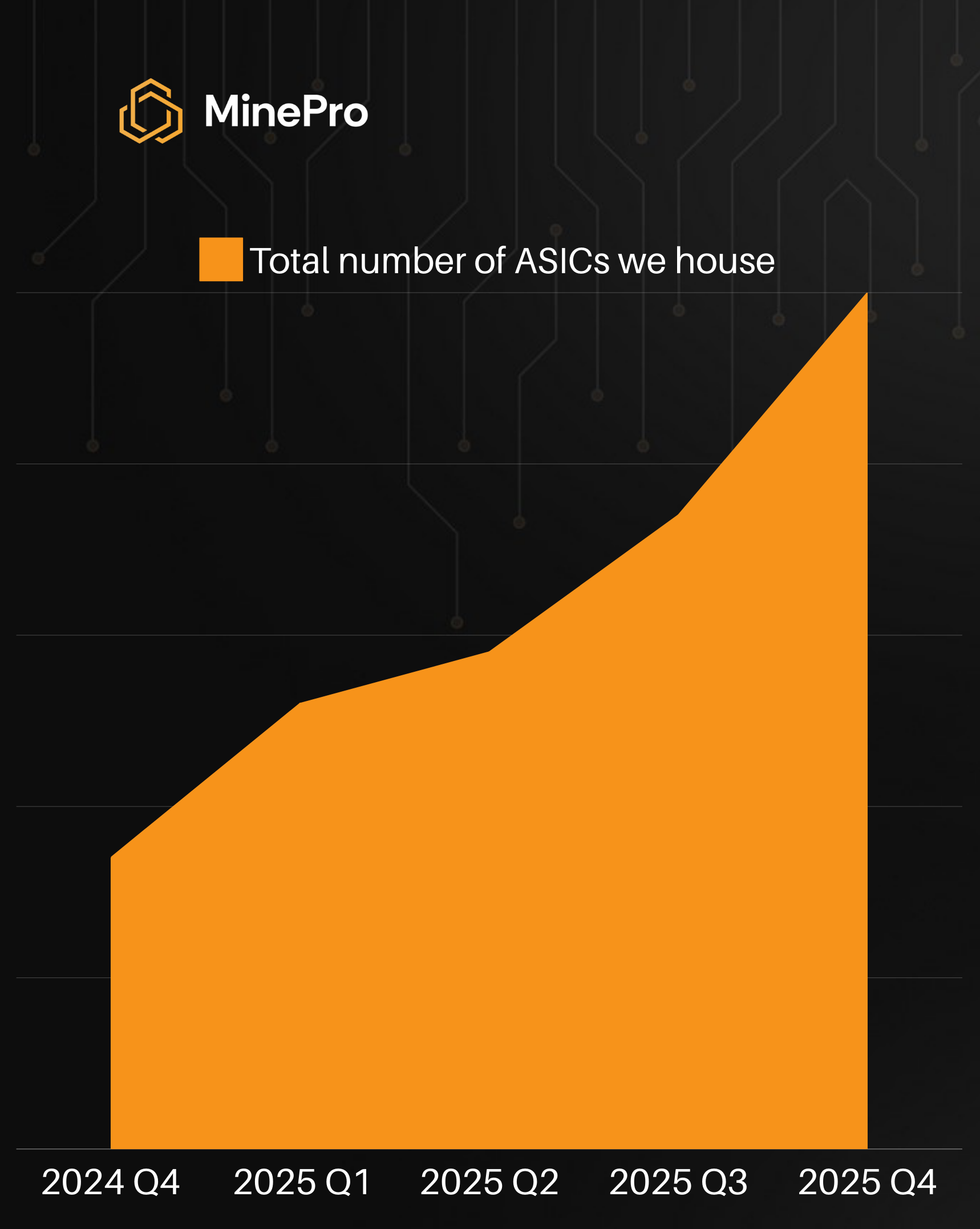

By building $MINE as a deflationary token as well as running our hosting business, MinePro prioritizes an increase in $MINE's yield percentage offering over time for staked investors. While it may seem counter-intuitive to reject a minting or traditional capital investment system for endless expansion of the amount of ASICs we house, we instead pursue a unique model wherein the offered yield percentage keeps increasing as the total supply of $MINE decreases, and the total amount of ASICs we house as well as Bitcoin we yield monthly increases. Meaning larger and larger monthly BTC rewards over time, with a lower and lower token pool for them to be shared to.

(note that both above graphics are projections)

Through building $MINE's tokenomics in this fashion, we have created a trading environment which will also gain value on token price through the speculation of market participants trading $MINE.

This is the mechanism which most cryptocurrency projects derive their sole value from.

While MinePro is an outlier in terms of deriving value from a real revenue source, it does not mean we can't ALSO gain extra value from setting our token metrics up in a way which encourages speculation, creating value for the DAO in multiple ways.