Opportunity size & scalability

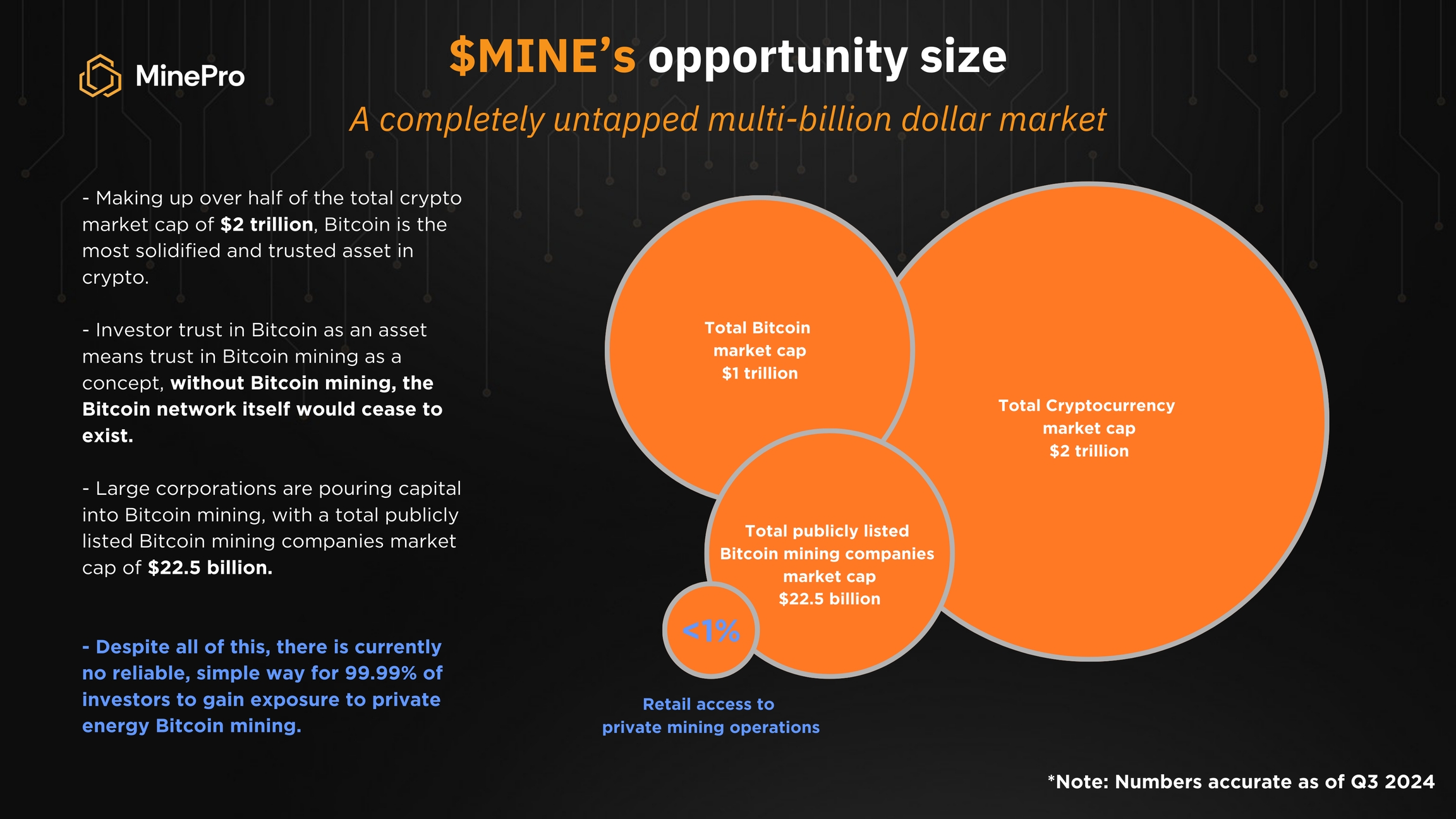

Bitcoin is the highest performing asset of the past decade and has solidified itself as the leader of the cryptocurrency industry, holding over a $1 trillion market cap and 55% market share of the entire cryptocurrency market. As well as only gaining more and more interest as of late from titans such as Grayscale and Blackrock.

It's clear the world can't get enough of Bitcoin, and as detailed in past pages of this documentation, it's clear that the most advantageous way to accumulate Bitcoin is through mining with private energy, with large corporations already taking advantage of this.

$MINE as the only publicly available way to gain access to this, has the potential to crack the industry wide open and become one of the most sought-after assets in the wider cryptocurrency industry.

It combines 3 key factors that make it so attractive to this wider market:

1 - High yield

2 - Well established, understood and trusted source of yield/investment (Bitcoin mining and Bitcoin mining machines [ASICS]) with no potential for complete loss of asset value or bank run (e.g. Terra Luna.)

3 - Completely non-existent complexity and barriers of entry to get involved, investing in $MINE is no more complex than buying Bitcoin itself.

Though $MINE is deflationary and does not employ a traditional expansion method, it has industry-wide potential through speculation to the point where $MINE price will have done multiple 100X before we need to expand our operations by introducing new pools.

It also should be noted that more $MINE will NEVER be minted, the total supply of $MINE will only reduce over time.

Last updated